SNB interest rate decision of 21 March 2024

The Swiss National Bank has decided to lower its policy interest rate by 0.25 percentage points to 1.5%. The SNB justified their decision with the successful inflation control measures taken over the past two and a half years.

For several months now, inflation has remained below 2%, which is well within the target range for price stability. According to current forecasts, inflation is expected to remain stable over the next few years. However, the SNB will continue to monitor inflation rates and adjust its policy rate further if necessary to ensure price stability in the medium term.

Inflation on the decline

Over the course of the past month, inflation has been consistently declining. In February, it stood at 1.2%. This puts it back within the target range for price stability according to the monetary policy strategy of the SNB already since last June.

The primary source of inflation is currently domestic goods, but even domestic inflation was below 2% in February for the first time in over a year. However, a potential inflation driver that is not yet reflected in current inflation rates is the adjustment of the reference interest rate from last December, which will only begin to impact rental prices in April (the notice date of many tenancy agreements. Nonetheless, the SNB has assessed inflation risks as sufficiently low to warrant a first interest rate cut.

Swiss franc is depreciating – good news for the export industry

Over the past three years, the Swiss franc's exchange rate had been steadily climbing. However, this trend has recently reversed. Since the beginning of 2024, the franc has lost about 3.7% of its value against the euro and over 4.3% against the US dollar.

This depreciation of the franc came at an opportune moment for the Swiss National Bank: While a strong franc can mitigate and in fact has mitigated the effects of imported inflation, it also significantly hampers the Swiss export economy by making it more expensive for foreign buyers to purchase goods and services in Switzerland. A lower franc exchange rate eases the burden on the export industry and serves to stimulate the economy, which is similar in effect to what an interest rate cut would achieve.

Further interest rate cuts possible in 2024

According to most analysts and financial institutions, it is expected that the SNB’s policy interest rate will be lowered again this year. The majority of analysts predicted three interest rate cuts in 2024 before today’s interest rate decision. However, interest rate forecasts remain somewhat uncertain.

Fixed-rate mortgages stable, rate cuts expected for SARON mortgages

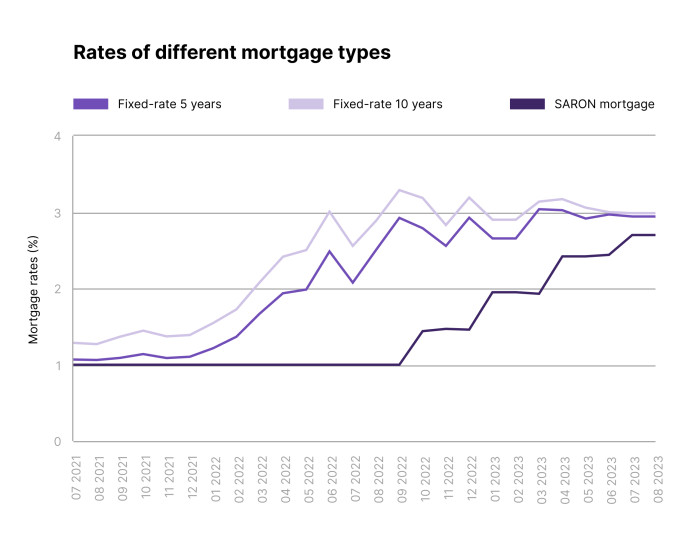

The past one to two years have been challenging for both existing and new homeowners. Following the surge in energy prices and the economic uncertainty related to the Ukraine conflict, mortgage interest rates for fixed-rate mortgages doubled or tripled. When the SNB began raising its key interest rate in June 2022, the SARON rate and consequently the interest rates for tracker mortgages followed suit. This suddenly made mortgages significantly more expensive for both existing and new property owners. Prospective buyers thus became more hesitant, and sellers had to list their properties for longer before finding the right buyer.

However, since mid-2023, the interest rate situation has gradually relaxed. Interest rates for fixed-rate mortgages have continuously decreased over the past year and are expected to remain stable in the coming months according to current forecasts. On the other hand, SARON mortgages will immediately become significantly cheaper following the SNB’s interest rate cut.

Lower interest rates felt on the real estate market

The effects of the lower mortgage rates have recently started being felt on the property market. As we show in the current Neho market report (currently available in German and French only), the number of properties listed for sale has been continuously declining since September 2023, with complementing signs seen on the demand side. Both are indications that there are more buyers on the market again looking to purchase a property.

Sell or valuate your property

The drop in interest rates has made it easier for sellers to attract buyers for their property. It’s thus an opportune moment for sellers to appraise their property's value and consider their options.

Are you thinking about selling your home? We're here to help. Book a valuation meeting with the local agent in your region or take the first step with a free online valuation in only 4 minutes by clicking the banner below:

SNB interest rate decision (14 December 2023)

The Swiss National Bank is leaving the SNB policy rate unchanged at 1.75%. The decision was justified by the declining inflationary pressure over the last quarter. However, uncertainty remains high, meaning the SNB will continue to closely monitor the development of inflation. The SNB will further adjust its monetary policy if necessary to ensure inflation remains within the range consistent with price stability over the medium term. Additionally, The SNB is still willing to be active in the foreign exchange market if deemed necessary.

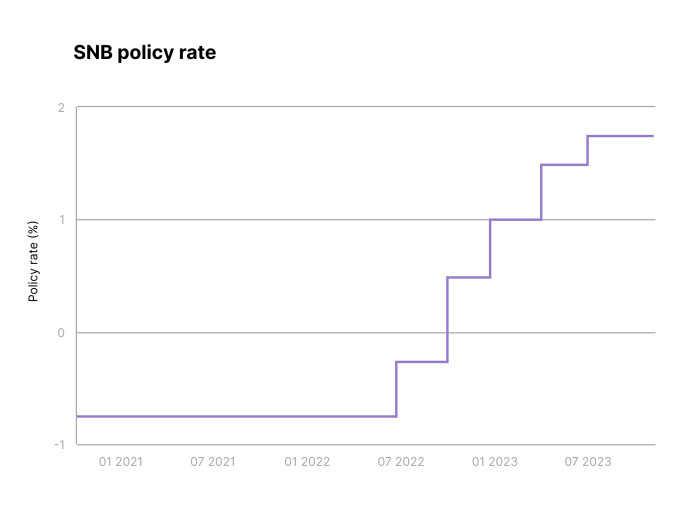

Source: Swiss National Bank. Forecast: UBS.

Inflation continues to decline

The SNB's interest rate decision did not come as a surprise this time; both the markets as well as most analysts had been expecting that the SNB would leave its policy interest rate unchanged in December.

The SNB continues to walk a razor’s edge: On the one hand, inflation has decreased significantly in the second half of 2023, reaching a one-year low of 1.4% in November – a sign that the past interest rate decisions are showing the desired effect. A similarly positive trend can be observed in the Eurozone, the United Kingdom, and the United States.

On the other hand, there are still significant inflation risks remaining. Rental increases, higher VAT, and increased energy prices during the cold months could cause a slight rise in inflation this winter. By deciding to keep the policy interest rate at 1.75% for a while longer, the SNB is choosing a middle ground between combating inflation and stimulating the economy.

Positive interest rate forecasts for 2024

Just a few months ago, "Higher for longer" was the prevailing sentiment almost everywhere. However, market sentiment has significantly improved in recent weeks. Following the decisions of the SNB, the European Central Bank, and the Federal Reserve in the United States, all of which have refrained from further interest rate hikes, recent forecasts have suggested that the SNB policy interest rate could be lowered as early as next summer.

Mortgage rates at a one-year low

The past one to two years have been a challenge for property owners, buyers, and sellers. After a multi-year phase with historically low interest rates, more than a year of uncertainty followed. Fixed mortgage rates rose rapidly, with considerable volatility and uncertainty of forecasts. SARON rates followed with a delay as the Swiss National Bank (SNB) began to raise its policy interest rate to combat inflation.

As a result, many prospective property owners had to reconsider their purchase. While it was possible to secure a fixed mortgage at an interest rate below 1% in early 2022, buyers now had to budget double to triple that amount. Although the mortgage approval criteria remained unchanged, the higher financing costs and the global economic uncertainty meant that buyers were more hesitant and less willing to spend money than before.

However, in recent months, there have been good signs for property owners and buyers. Firstly, there are the aforementioned interest rate forecasts, expecting that the SNB policy interest rate could be lowered in mid-2024. Additionally, mortgage rates have decreased significantly and, as of December 2023, they are at a one-year low. This should lead to an increase in the number of buyers in the market, making it easier for sellers to find a buyer for their property.

Source: Swiss National Bank.SARON rates are based on the base interest rate plus a typical margin of 1%. The base interest rate can never be lower than 0%.

SNB interest rate decision of 21.09.2023

SNB interest rate decision

The Swiss National Bank announced at today's press conference in Zurich that for now, it will not further increase its policy interest rate. The monetary policy, which has been significantly tightened over the past quarters, is now acting to counter the persistent inflationary pressure. However, the SNB will closely monitor the further development of inflation in the coming months and will not hesitate to take further action to ensure price stability in the medium term. To maintain appropriate monetary conditions, the National Bank is also prepared to be active in the foreign exchange market, with a focus on selling foreign currency.

Source: Swiss National Bank.

Inflation is declining, but for how long?

According to the Swiss National Bank's monetary policy, price stability is achieved when inflation falls within 0 to 2 percent. This target was recently met again: after inflation in Switzerland was as high as 3.4 percent in February, it has steadily decreased since, reaching 1.6 percent in August 2023, the same as in July. The SNB’s decision is therefore understandable from today's perspective. However, forecasts were clear: The SNB will not hesitate to further increase the interest rates if inflationary pressure requires it.

While prices for imported goods have indeed normalised, partly thanks to a strong Swiss Franc, domestic goods remain more expensive than they were a year ago. Additionally, some of the declining inflation can be attributed to so-called base effects: if specific goods or services in Switzerland were exceptionally expensive in the previous year, and their prices have since returned to normal, the unadjusted inflation rates for the following year will appear too low. Most notably, this was the case with oil prices in the aftermath of the Russian-Ukrainean war. As these base effects drop out of the statistics, inflation will start to rise again.

Furthermore, there are new inflationary challenges to consider. A first wave of rent increases is expected by the end of 2023, and in the new year, health insurance contributions and electricity prices are set to rise significantly. Housing costs, energy, and healthcare account for more than 40 percent of average household expenditures and will thus have a notable impact on overall inflation. However, the SNB’s longer-term inflation forecasts are cautiously optimistic at 2.2% for 2023 and 1.9% for 2024 – assuming that there won't be an energy shortage with large-scale production losses during the winter.

Economic outlook has worsened

Growth, inflation, and policy rates:When inflation rises, central banks increase their policy rates, making loans more expensive. This reduces the amount of money in circulation and lowers demand. While this leads to lower prices, it also slows down economic growth.

After a solid first half of 2023, sentiment in the Swiss market has recently taken a turn for the worse. For 2023, the expert group on business cycles of the Swiss government has forecasted significantly below-average growth of 1.1%, while the SNB’s recent forecast has growth at around 1.0% in 2023. There are several contributing factors: Although inflation and the SNB’s interest rate hikes remain low by international standards, the Swiss economy is slowly beginning to feel the effects of the restrictive monetary policy. The strong Swiss Franc and below-average demand will also weaken exports. And lastly, domestic inflation is still a concern. As mentioned, rising rental prices, healthcare costs, and electricity prices will further strain the wallets of Swiss consumers in the coming year, dampening consumption. A recovery of the economy with an expected growth rate of 1.5% is currently projected for 2024.

How have current interest rates affected the real estate market?

The challenging economic situation and the SNB’s tight monetary policy over the last 15 months have left their mark on the real estate market. As a result of the Ukraine conflict and inflationary pressures, fixed-rate mortgage interest rates increased by more than 1.5% in the first half of 2022. This suddenly made tracker mortgages (SARON) much cheaper by comparison. However, as the SNB began raising its policy rate, the difference between the two has continuously been growing smaller, and switching to a fixed-rate mortgage has now become the preferred option again for many homeowners with a SARON mortgage.

The higher mortgage interest rates are felt in particular by homebuyers. While it was possible to secure a fixed-rate mortgage below 1% just two years ago, rates have since doubled or even tripled. And while the affordability criteria for mortgages have remained unchanged, it’s understandable that some buyers will be reconsidering whether they can or want to become homeowners given the current interest rate environment. As expected, demand for homes has decreased, impacting the price dynamics. While property prices are still on the rise in many places, the rate of increase has slowed down.

For existing homeowners, the impact of interest rate increases varies depending on their mortgage product. Homeowners with a tracker mortgage are directly affected by changes in the policy rate, as SARON closely tracks the SNB policy rate. However, the majority of property owners will only feel the increase in interest rates when the time has come to renew their mortgage, as fixed-rate mortgages are by far the most common type of mortgage in Switzerland.

Source: Swiss National Bank.SARON rates are based on the base interest rate plus a typical margin of 1%. The base interest rate can never be lower than 0%.

ECB and Fed: Switzerland remains relatively unscathed

Even though the economy and the population have certainly felt the effects of inflation and rising interest rates, looking abroad reveals how once again, Switzerland has gotten off lightly. By comparison: the European Central Bank deemed it necessary to raise its key interest rate from 0% to 4.5% in just over a year to combat soaring inflation in the eurozone of up to 10%. A comparable trend was seen in the United States: between March 2022 and May 2023, the US Federal Reserve had to raise its key interest rate a total of ten times in order to combat the highest inflation rate since the early 1980s.

However, in both countries, as well as in the Eurozone, there are signs that the end of the interest rate cycle is slowly but surely approaching. The Fed has recently refrained from further adjusting its key interest rate, and most experts believe that the peak in interest rates may have been reached in both the Eurozone and the United Kingdom as well.

But why were inflation and the associated interest rate hikes so much higher abroad when compared to Switzerland? This can be attributed to several factors: In times of crisis, the SNB can allow the Swiss Franc to appreciate to make imports cheaper, thus mitigating the impact of imported inflation. Additionally, in comparison to countries like Germany, Switzerland is much less dependent on gas and oil. Lastly, there are strong protectionist agricultural policies in place in Switzerland, which stabilise food prices by means of variable import duties. As a result, when compared to many other countries, price levels in Switzerland are less tied to fluctuations in international markets.

Summary and outlook

- The SNB has left its policy rate at 1,75% as per 21.9.2023. The next interest rate decision will follow on December 14th.

- Inflation has decreased since the beginning of 2023 but is expected to rise again towards the end of the year. Forecasts are subject to a lot of uncertainty.

- Spiking interest rates have led to a reduced demand for real estate. This has served to partially counteract the price trend of the past couple of years. Therefore, we are seeing a lower transaction count, but also reduced competition among sellers.