A tense supply market

For several years now, the real estate market has been hit by a decrease in the number of properties for sale, so the supply has never been as poor as it is today. This sharp decline is due to several factors, including the slowdown in the construction of housing for homeowners. For several months now, the number of building permit applications and approvals has been falling and seems to be at a low point throughout Switzerland. In addition, more rental properties have been built than ownership units, thereby further reducing the supply of housing available on the sales market.

Furthermore, there are growing supply problems for raw materials linked to the Russian-Ukrainian conflict and China’s zero Covid strategy. These difficulties lead to an increase in the cost of materials and an increase in construction time, further impacting the supply of new housing available and accentuating the lack of properties available for sale.

In the third quarter of 2022, none of these factors seem to have abated, quite the contrary, and it is easy to say that the shortage of properties for sale is still rampant.

Rising interest rates

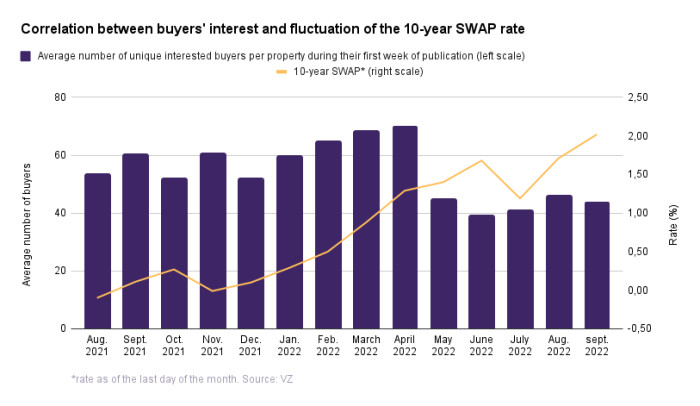

Since 2021, the 10-year SWAP rate has been rising steadily and has recently been very volatile. In fact, it reached record highs in June and September. This echoes the various announcements by the Swiss National Bank regarding the decision to increase its key rate twice. However, it should stabilize over the next twelve months if we are to believe the predictions of the country’s largest banks.

For the consumer, and more precisely for new buyers, these changes have had a direct impact on the mortgage costs, which have increased significantly compared to last year. An increase that may also impact current homeowners when they negotiate their mortgage if the rate of their current mortgage is lower than the rates charged by their financial institution at the time of renegotiation.

Even if the cost of becoming a homeowner has risen, ownership remains beneficial since it offers many tax advantages that should be discussed with a financial advisor. We also note that non-financial, more personal factors enter into the equation and motivate future buyers to become homeowners.

A declining, but still high, number of buyers

At Neho, we see a certain correlation between fluctuations in mortgage rates and the interest of potential buyers, even if there is a certain time lag between these two events.

Indeed, if the chart above is to be believed, it appears that the appeal of homeownership to buyers grew between August 2021 and April 2022. And for good reason: even though mortgage rates continued to rise, they remained at levels that are still attractive to anyone looking to buy a home. For example, demand was high for several months before declining sharply in May 2022 and bottoming out in June as the 10-year SWAP rate rose to over 1% in April 2022.

Even though demand is still at a low level in the third quarter of 2022 compared to the beginning of the year, it is stabilizing and remains above the level reached at the end of the second quarter. This is proof that buyers are beginning to accept this situation of rising rates and are still looking to become homeowners despite everything.

This decrease is also felt on the number of buyer profiles created on the Neho platform.

While in the second quarter of 2022 more than 13,000 new buyers registered, only 11,700 created a personal account on the platform in the third quarter, a decline of 10% in just a few months. Even if this decrease may seem significant at first glance, it is not alarming since the number of potential buyers is still high, so there is always at least one buyer ready to make an offer at the price requested by the seller.

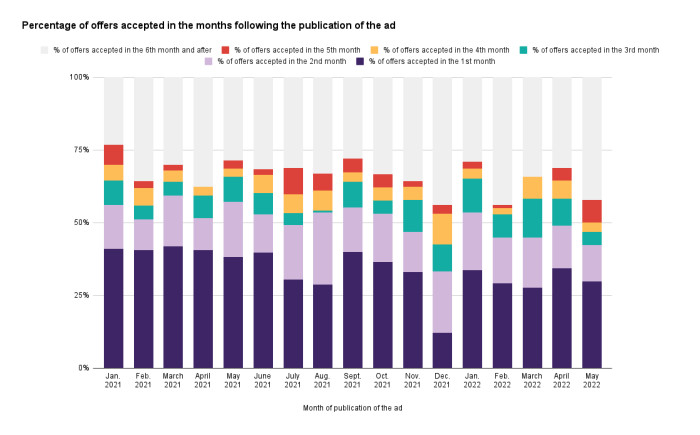

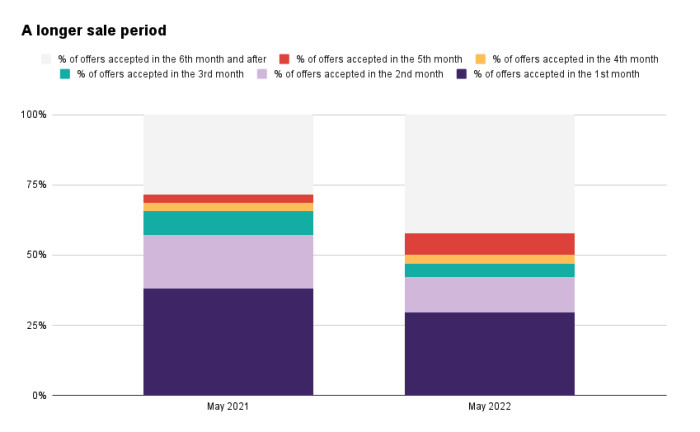

In addition to a decrease in the number of buyers, we are also witnessing an increase in the time it takes to sell a property compared to last year.

In May 2021, we counted 71% of accepted offers during the first 5 months after publication of the ad. In May 2022, one year later, this figure had gone down sharply to 58%, or 13 points less.

It is easy to see that properties put up for sale since the beginning of the year are taking longer to find buyers than those published last year. This phenomenon echoes the decrease in demand observed previously.

Prices are still on the rise

It seems that the latest events and changes have not reversed the dynamics of real estate prices, which continue to rise. According to the SWX IAZI Private Real Estate Price Index, the price of single-family homes has increased by +2%. Condominiums, on the other hand, saw a price increase of +0.7% between the second and third quarters of 2022.

For the time being, no contraindication to selling

Finally, despite a recent slowdown in demand, it seems that prices in the Swiss real estate market have not been impacted during the third quarter of 2022, quite the contrary, since demand has always remained in excess of supply, even if sales times have been revised upwards.

- 150’000 active buyers in the database

- +3’7000 clients

- +2 billions francs in transaction value

- 4,7/5 based on more than 850 reviews

- +80 employees

- +1’000 properties sold in 2021